Using Your IRA to Buy Real Estate

Is this unorthodox investment idea underappreciated?

You can invest your IRA assets in different ways. Should you invest a portion of those assets in real estate?

At first thought, putting real estate into an IRA may seem like an off-the-wall idea. It is one you might want to consider, but you must be aware of the rules. The concept is not new, but it has been slow to gain acceptance. Less than 2% of IRA assets are held in real estate.1

The 2007-09 bear market led some IRA owners to explore alternative investments. That was when the term “self-directed IRA” entered the investing lexicon. As the stock market tumbled, a cottage industry of investment firms emerged urging IRA owners to direct IRA assets out of equities and into real property, real estate notes, and real estate investment trusts (REITs).2

No law prohibits an IRA owner from doing this, but many financial firms serving as IRA custodians do. So if you want to invest in real estate through your IRA, you must first check to see if your IRA custodian will allow it. If it is allowed and you proceed, you are on your own: your IRA will be self-directed, your IRA custodian will make no effort to advise you about your investment choices, and you alone will be responsible for your investment decisions. That is a risk you may or may not be willing to take.2

Holding real estate in your IRA means looking at your IRA differently. To lesser or greater degree, your IRA transforms from a dedicated retirement savings vehicle to a real estate investment vehicle. If you are more knowledgeable about the housing market than the stock market, you may prefer it this way.

Whether you know volumes about real estate or not, you must abide by the particular regulations and mechanics involved.

Self-dealing is outlawed. Legally, you can buy any form of real estate with your IRA assets, but you may not buy real property that will be used as your home or your place of business. Your IRA (which is by definition a trust) may not purchase any real estate that you own, or any real estate that is owned by a business in which you or certain members of your family have an ownership interest. It is also barred from selling any real property it holds to you or such business entities.1,2

You buy or sell real estate through the IRA custodian. The mechanics of making the actual transaction are fairly straightforward. You instruct your IRA custodian to authorize the purchase or sale of a property, providing the required documentation to facilitate that purchase or sale. The IRA custodian then commences to buy or sell the property for your IRA, with the title to the property vested in the name of the custodian. You have to have enough IRA assets to cover 100% of property management and property-specific expenses linked to the transaction; failing to have sufficient assets to cover those costs may mean penalties or forfeiting tax benefits.1

Proceeds from sale & rental income go right back into the IRA. This is necessary so that the account may retain its tax-deferred status. These newly invested assets get the same amount of creditor protection the IRA affords to other assets. The level of protection varies per state, though, and IRA assets are not protected against civil lawsuits.1,3

Do you need to form an LLC? Some owners of self-directed IRAs do just that, so that they can have checkbook control over their IRA assets. How does this work? The LLC sets up a bank account for the IRA owner, allowing him or her to write checks on behalf of the IRA. The LLC facilitates transactions for the IRA owner, instead of the IRA custodian.1

There are some notable benefits to adopting the LLC structure. Timing can be everything when it comes to a real estate transaction, and having a “checkbook IRA” gives you a chance to buy foreclosures on the steps of your local courthouse with IRA assets. An LLC structure may lower some custodial costs associated with IRA administration, and it also permits the IRA owner the option of handling some property management duties such as bill paying, advertising, and collection and deposit of rents. On the other hand, since an IRA is a trust from its inception, the LLC structure is technically superfluous.1,2

If you want to hold real estate in an IRA, speak with a tax or legal professional first. You must understand what you are getting into, and the full tax details are beyond the scope and length of this article. Using your IRA to invest in real estate could be an auspicious move; it could also breed complications. Remember that an IRA is not a prerequisite for real estate investment.

Alternative to holding real estate directly is through a Real Estate Investment Trust This can be an easier and convenient way to gain real estate exposure without having to use a special custodian and follow the strict custody rules, not to mention having to be a landlord. Below is an excerpt from a 2017 article on REITs. You can go straight to the article here.

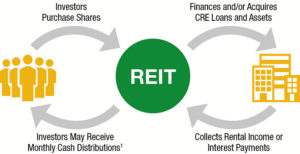

What is a REIT? A real estate investment trust (REIT) is a real estate investment company that manages a portfolio of income properties, distributing the lion’s share of its profits as dividends. By getting into a REIT, you can gain an ownership interest in prime commercial real estate, without the headaches of commercial real estate management.

How do REITs work? On one level, a REIT is an agreement with the Internal Revenue Service. In choosing a REIT structure, a real estate investment company agrees to pay out 90% or more of its taxable profits in dividends in exchange for avoiding corporate income tax.

The typical REIT is a public REIT, with investors buying shares in the trust. These shares are sometimes casually referred to as “real estate stock.” Like any other stock, a REIT stock offers you the potential for dividend income and share value appreciation.

REITs pay no corporate taxes, so their total returns can be impressive. For example, REIT Realty Income, a top net-lease retail REIT, has returned an average of 16.9% a year (including dividends) since its 1994 New York Stock Exchange debut. REIT Welltower, a prominent health care REIT, had its IPO back in 1971; since then, its yearly total return has averaged 15.6%. Regarding index performance, the NAREIT index of publicly traded equity REITs had an annualized return of 9.67% during 1997-2016, versus 7.68% for the S&P 500.

In addition to equity REITs, you can also explore mortgage REITs, which invest in home loans and mortgage-linked securities, and hybrid REITs, which invest in both real estate and mortgages.4

REIT dividends are usually paid out as ordinary income. Sometimes, though, a REIT may choose to categorize a dividend as a return of capital, which results in tax deferral and a lower taxable income for the investor during the period he or she holds the stock. That can boost the after-tax dividend yield.

Two other nice things about REITs are worth noting. They don’t pass tax losses on to investors, and they often have low investment minimums.

Not all REITs are listed on stock exchanges. Some are non-traded. These REITs are akin to private equity funds – they are usually conceived to last for a certain number of years before either listing their shares, selling out, or liquidating. While their dividend yields may potentially surpass those of publicly listed REITs, non-traded REITs are also fundamentally illiquid until they liquidate or go public. Typically, assets directed into a non-traded REIT are out of an investor’s reach for seven years or longer.

Are REITs right for your portfolio? Many investors are considering REITs these days, attracted by the diversification they provide for a portfolio. They can choose from REIT mutual funds, closed-end funds, and REIT ETFs, among other options.

Download your free Guide to Understanding Real Estate Investment Trusts.

Contact us to learn more…

Subscribe to be notified when a new article is posted.

JST Investment Consulting does not provide tax or legal advice. The information presented here is not specific to any individual’s personal circumstances. To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable. The information in these materials may change at any time and without notice.

Citations.

1 - investopedia.com/articles/retirement/08/self-directed-real-estate-iras.asp?no_header_alt=true [1/11/16]

2 - money.usnews.com/money/blogs/the-smarter-mutual-fund-investor/2015/01/28/investors-see-benefit-in-using-iras-for-real-estate [1/28/15]

3 - chicagotribune.com/news/sns-wp-blm-retire-comment-ab936112-b3d0-11e5-8abc-d09392edc612-20160109-story.html [1/9/16]Asics footwear | Fullress , スニーカー発売日 抽選情報 ニュースを掲載!ナイキ ジョーダン ダンク シュプリーム SUPREME 等のファッション情報を配信!