Financial and Estate Planning

A sound financial plan is much like a well-constructed home. It uses building blocks that provide support as you pursue your financial goals. Each building block – from cash flow to estate planning – will be prioritized and a serve as a vital component to achieving your goals. Financial planning and goal setting are included as part of our Active Investment Management solution. Otherwise, depending on scope, planning services are priced as a project based fee or at an hourly rate. Key 6 items we will look at:

- Cash Flow – Analyze your existing cash flow and financial position. In this component your we will summarize and assess your income and expenses, key budgeting issues and your cash reserves for emergencies or other opportunities.

- Risk Management – Identify potential risks – loss of health, property, income or life – and develop strategies to protect against each risk.

- Accumulation/Investment – Invest for specific accumulation goals, such as education or home purchase. In this component your we will develop investment strategies based on your time frame and risk tolerance and recommend asset allocation.

- Income Tax – Identify appropriate tax-savings strategies available for your specific situation.

- Retirement – Evaluate your retirement needs and develop strategies for the accumulation and distribution phases of your life.

- Estate Planning – Plan for your estate planning and wealth preservation needs, including strategies to ensure that your wealth is preserved and passed efficiently and cost-effectively to the people or organizations you wish, at the time and in the manner you want. If needed, additional elements in this process can include wealth forecasting, business planning and succession planning. We offer in-house living trust services for a low flat fee and, in some cases, included for no additional cost as part of our comprehensive wealth management service package.

What does the word “money” bring to mind? Are the associations positive or negative?

Beliefs about money are complicated. It’s a symbol of one’s self: respect, love, freedom, control, power, worth, and much more (depending on the person).

Having a healthy relationship with money and using it to create success require you to understand the beliefs and internal scripts driving your behavior. Trying to build strong financial habits without the right mindset is like driving down the highway with your emergency brake on.

“As a financial professional, I think about wealth in terms of the opportunities it offers and as a tool for good. But, I’ve realized that everyone who walks in my office doesn’t view money the same way. For some people, money is uncomfortable and something they’d rather not think about. Others tie wealth to their definitions of success and self-worth.”

Investment Management

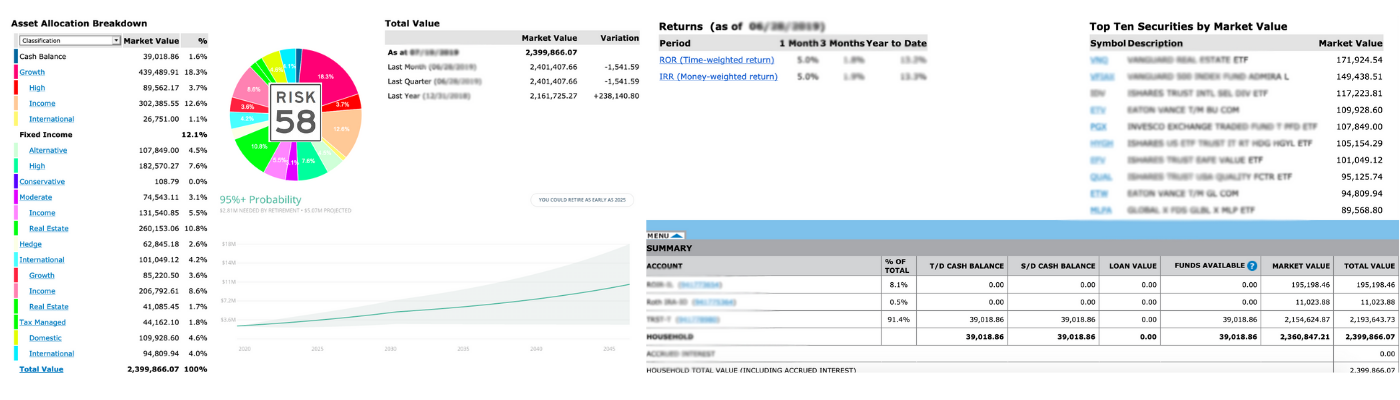

JST Investment Consulting tracks your overall investment portfolio and works with you to make adjustments based on market conditions and your unique goals and needs. We use a number of risk management techniques to ensure you are invested within your risk parameters. It is our goal to help achieve financial goals through prudent planning and implementation. Our unique Investment Policy Statement outlines our strategy to meet your objectives.

Your personal portfolio may be created using a broad range of investment choices in many asset classes and financial markets. We use the following investment options for your individual and retirement assets:

Active Investment Management is our most comprehensive and cost effective wealth management option. Bring all your investments together into one coordinated and flexible portfolio we manage for you. Your account(s) will be allocated according to your investment needs, with the added benefits of ongoing financial planning and portfolio reviews. We make timely investment recommendations that you review and approve.

As part of the comprehensive approach, you will have 24/7 access to a proprietary website portal at JSTClient.me to view your performance, asset allocation, investment tracking reports, financial document storage and more.

JST Investment Consulting, Inc. has selected Charles Schwab & Co., Inc. (Schwab) as primary custodian for our clients’ accounts. With Schwab, you will be assured that you will receive best execution and timely trades on a trusted platform. Additionally, Schwab is a member of the Securities Investor Protection Corporation (SIPC), which protects securities held by investors up to $500,000, including up to a maximum of $250,000 for most cash claims. Schwab provides each client $600 million worth of protection for securities and cash through supplemental SIPC excess coverage. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. More information on Schwab account protection can be found here. Along with our proprietary investment online portal, you will have online account access directly with Schwab.

Investment Consulting Accounts are designed for investors either just starting to save towards their future or not needing comprehensive management, but want to build upon their financial nest egg with the assistance of a financial advisor. Through ongoing financial consulting, we tailor your investment needs to your long-term financial goals.

We set you up with a diversified investment portfolio at Betterment and access to an investment website portal to track your investment holdings. Pricing is affordable, transparent, and scaled for every investor's life stage.

Your emotional reactions to investing can have a powerful impact on your long-term finances.

Do you act on your friends’ stock tips?

Do you leave a pile of unopened statements on the counter?

What does that say about your investing?

You might think that investing is all about numbers and analysis, but you’d be underestimating the impact your personality has on how you spend, save, invest, and borrow.

Understanding yourself can help you become a better investor.

Take a short quiz that identifies some of the most common traits and personality types in investing.

We bet you’ll learn something surprising about yourself in just 7 questions.

Low Cost Life Insurance and Annuity Solutions

JST offers Low-Cost and in some cases, No Commission Life Insurance and Annuity solutions exclusively through our insurance partners. Tax deferred products may be used for tax and family planning strategies. JST is not compensated by our insurance partners, but may charge a consulting fee. Each of the companies we work with have been vetted by us and are in alignment with the Fee-Only® Fiduciary promise.

Proper life insurance can be a large expense in a family or company budget. Contact us to learn how you may save 30%-40% over traditional high commission, life insurance products. This is a unique and exclusive offering for clients of JST Investment Consulting.

Here are a few of our insurance partners:

Small Business Solutions

Here are 3 very compelling reasons:

- Your plan not only helps secure your future—it may be the primary way your employees can help secure theirs.

- Offering a plan helps make your business competitive when it comes to attracting and keeping good employees.

- There are potential tax benefits to offering a plan, because plan contributions for the business owner are deductible as a business expense.

- Simplified Employee Pension Plan (SEP IRA)

- For self-employed people and small-business owners with any number of employees. Contributions are made by the employer only and are tax-deductible as a business expense.

- Savings Incentive Match Plan for Employees (SIMPLE IRA)

- For businesses with 100 or fewer employees and is funded by tax-deductible employer contributions and pretax employee contributions [similar to a 401(k) plan].

- Self-Employed 401(k) plan

- For self-employed individuals that offers the most generous contribution limits of IRA plans, but is suitable only for businesses with no "common law" employees, meaning any person working for the business who does not have an ownership interest.

- 401(k) plan and Safe Harbor 401(k)

- For businesses funded by tax-deductible employer contributions and pretax employee contributions. May also provide Profit Sharing contributions. Safe harbor 401(k) plans can be a great choice for small businesses that have trouble passing 401(k) testing.

401(k) Retirement Plan Administration Services*

JST provides 401(k) plan administrative services including:

- Compliance and Coverage Testing ; Safe Harbor

- Employer contribution modeling and allocation

- Expert advice on operating your plan most effectively

- Annual reviews to ensure plans are operating effectively and meeting goals and objectives

*Plans are custodied by third party 401K service companies and JST acts as the advisor for the plans. Owners and employees use JST as the direct service arm for implementation, investment and general administrative matters.

JST Investment Consulting has selected Charles Schwab & Co., Inc. as primary custodian for our clients’ accounts.

To Check Firm or Individual Backgrounds please go to SEC's Investment Adviser Public Disclosure website.

Copyright © JST Investment Consulting, Inc.